Contents

Shows the Excel PV operate used to calculate the current value of an funding that earns an annual interest rate of four% and has a future worth of $15,000 after 5 years. A stream of money flows that includes the same amount of money outflow each interval is called an annuity. When each period’s rate of interest is the same, an annuity may be valued using the PV perform. The Excel FV operate is a financial function that returns the long run worth of an funding.

- The investment is said to bring an inflow of Rs. 1,00,000 in first year, 2,50,000 in the second year, 3,50,000 in third year, 2,65,000 in fourth year and 4,15,000 in fifth year.

- NPER calculates the number of periodic payments to be made if the rate of interest remains constant and the opening and closing balances are known.

- The present value of $10,000, if you were to receive it today, would obviously be $10,000 since that is what your investment would yield you right now if you were to use it.

- Net current value method is a software for analyzing profitability of a particular challenge.

You are required to calculate the MIRR of the investment. You are required to calculate the IRR of the investment. John is considering the financial viability of an investment. You are required to calculate the XNPV of the cash flows. Rateis the discount rate to be used for discounting the cash flows.

EMI Calculation Methods

This Rs 100 which you might be investing at present is known as current worth of Rs 110. Future worth is that value which will be the value sooner or later. Present value helps in taking selections on investment which relies on the current worth. So present worth is the present value of the cash flows which will happen in future and these money flows occur at a reduced price. If you could have the option of choosing an annuity or a lump-sum fee, you’ll want to understand how much your remaining annuity funds are value so you possibly can choose.

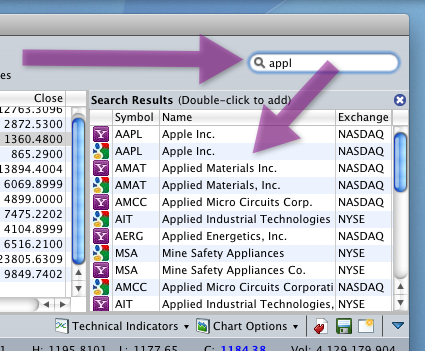

I, Mr Excel will share some functions, which will greatly help you when you give your clients financial advice. RATE is calculated by iteration and can have zero or more solutions. Now we find the internal rate of return by putting different “ i “ ‘s values and try to get a solution as zero.

How Do You Calculate Return on Equity (ROE) in Excel?

Given a predetermined rate of return, Present Value is the current value of a future quantity of money or cash flow stream. Assuming that all of the above projects are mutually exclusive, the best project from the list is project B. This is because it adds the maximum value for the shareholders, when compared to the other options. The projects E and F have a negative value and will therefore generate a loss on the investment. The Net Present Value method is a very popular technique that is used by the management to select the projects that can create the highest value for shareholders. As a rule of thumb, the projects with a positive value will generate profits and the projects with a negative value will lead to a loss on the investment.

See the calculation in cell G11 and the formula syntax in G13. Returns the amount on the principal for a given period for a loan based on periodic, constant payments and a constant interest rate. Returns the regular monthly payment on the loan (principal + interest) when the interest for each of the monthly payments is constant.

Use these excel tools to assist your clients in their financial needs. The present value is negative as it is the money given by the investor. Since the NPV is positive the investment is profitable and hence Nice Ltd can go ahead with the expansion.

Payment of EMI is spread over the loan tenure that is opted for by the borrower. You can easily compute returns generated on a client’s investment using XIRR function whenever a client’s portfolio has generated positive returns. The NPV method also makes a lot of assumptions in terms of inflows, outflows. There might be a lot of expenditure that will come to surface only when the project actually takes off.

What is the Present Value Formula in Excel?

To know whether to invest or not, it has to conduct a net present value of that product. But the best thing is that the net present value method helps us to analyze those things and give us a direction for a better investment. So I will discuss all these tools, which helps you make faster decisions, and also grow your business.

If the result is a positive NPV then the project is accepted. It is also a tool which we can use to predict the profitability of an investment, and give us the right directions to invest. And one of the limitations of these tools is that they don’t use the real values, they use estimating values for this project.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment. So, if we only consider the NPV of each project and ignore all the other factors, then the management should implement the projects A, B and C and reject the projects E and F. Whereas, the project D just manages to break-even so it does not matter if it is selected or rejected. Let us suppose that the following 6 projects are available for the management of a company to execute.

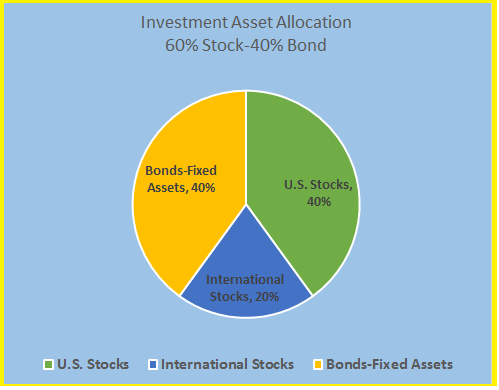

Investment for all

On the contrary, it’s better to pay attention to cash inflows first and outflows afterwards. NPV helps estimate the worth of a project, an investment, or any set of cash flows. It is a comprehensive statistic considering all Income, expenditures, and capital costs related to a given investment.

PV function denotes the Present Value of the investment. It will help us to calculate the present value of future investments. The PV function calculates the present value for today when you know the annuity value yearly or per month, rate, and the number of years. PV function will tell you how much you need to save today in order to spend a particular amount in the future. Money in the present is worth more than the same amount in the future due to factors like inflation and opportunity cost.

This is a very important side and is rightly considered underneath the NPV technique. NPV or net current value is the summation of all present values of a series of funds and future money flows. The number of compounding durations during each time-frame is a vital determinant within the time worth of money formulation as properly. The time value of cash is the concept that money you could have https://1investing.in/ now could be value greater than the identical sum in the future due to its potential earning capacity. This core precept of finance holds that offered money can earn curiosity, any sum of money is price extra the earlier it is received. Do you know that the total of future investment returns that are discounted at a given level of expected return is used to determine the present value ?

In addition, the NPV of the costs and benefits can be calculated separately to compute the Profitability Index of a project. Typeis the logical value; you should enter 1 if the EMI payment is at the beginning of the period, or 0 if the EMI excel present value formula payment is at the end of the period. The PMT or payment function helps calculate the loan EMI. If IRR is less than the cost of capital the project is value destroying. If IRR is greater than cost of capital the project is value creating.

Net present value is the present value of cash inflows minus present value of cash outflows. It is used for making capital budgeting/ investment decisions. Decisions could be for an investment in or replacement of a fixed asset, investment or acquisition of a Company or Investment in a Capital-intensive project.